Kontos examines price & volume trends for ‘late models,’ EVs & hybrids

Chart courtesy of ADESA.

Along with highlighting overall value trends, ADESA chief economist Tom Kontos offered a closer examination of two specific parts of the wholesale market.

Kontos looked at what he considers to be “late-model” used vehicles as well as electric vehicles and hybrids.

First, let’s begin with the overall numbers included in the newest Kontos Kommentary released on Monday.

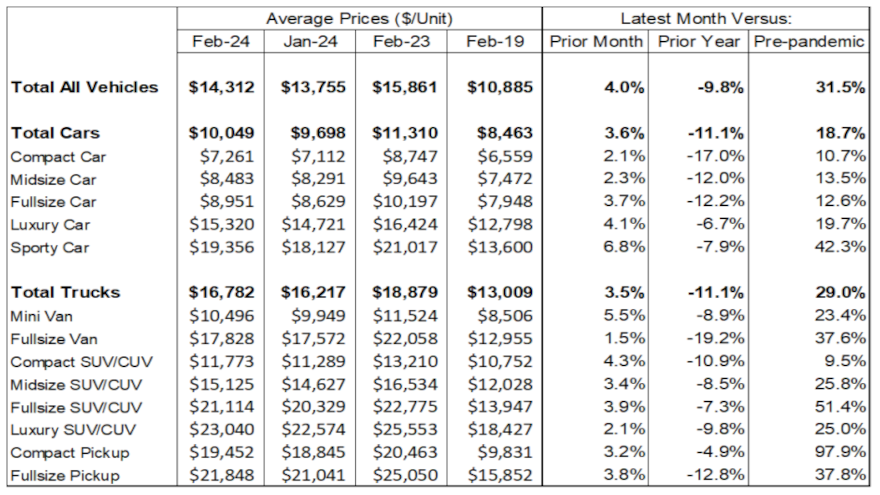

According to ADESA U.S. Analytical Services’ monthly analysis of auction industry used vehicle prices by model class, wholesale prices in February averaged $14,312 — up 4.0% compared to January, down 9.8% relative to February of last year, and up 31.5% versus the pre-pandemic timeframe in February 2019.

“Spring appears to have sprung in the wholesale market, as average prices jumped another four percent month-over-month in February and have continued to rise significantly in March,” Kontos said in the report.

What about those late models? They are what Kontos put in the off-lease and off-rental categories. They’re vehicles up to 3 years old with less than 45,000 miles.

“Average prices for ‘late model’ used vehicles have risen faster than overall prices so far this year,” Kontos said. “Average prices for these late-model vehicles have continued to rise in March and stood at $25,348 for the week ending March 17.

“These rapid price rises are indicative of interest by consumers, and therefore dealers, in more-affordable substitutes for high-priced new vehicles,” he continued.

What about EVs and hybrids?

Kontos acknowledged “a lot of ink has been spilled not only on EVs, but increasingly on hybrid vehicles. I thought it timely, therefore, to share a couple of graphs I’ve developed to monitor auction price and volume trends for these alternative fuel vehicle types.”

Kontos used the #TrendSpotter segment of his latest analysis to pinpoint the percentage of volume for EVs and hybrids within the entire wholesale market. The ADESA expert pegged the volume level at 1.3% for EVs and at 2.2% for hybrids.

“These volume trends tend to lag new-vehicle sales trends by a few years, so it will be interesting to see how these patterns may change over time,” Kontos said.

Kontos also tracked wholesale prices for these vehicles, putting the March reading for EVs at $24,992 and for hybrids at $16,536.

“Average hybrid vehicle prices have gone from being below-market to above market; although this could perhaps be partially due to changes in model mix,” he said.

View The Latest Edition

View The Latest Edition