Latest Wolters Kluwer industry survey pinpoints where digital adoption still lags

Charts courtesy of Wolters Kluwer.

Last week, Wolters Kluwer announced results from an industry survey it commissioned to better understand where automotive, dealer and auto finance professionals are finding operational improvements in adopting digital back office workflows.

Wolters Kluwer also wanted to gauge existing barriers in adopting digitized solutions as 2024 rolls along.

Wolters Kluwer presented an online survey to more than 2,200 automotive dealer, finance company and service provider professionals during December. According to the survey results, 22.7% of respondents said they are currently utilizing digital finance solutions.

Approximately 21% of respondents said they haven’t yet found the right solution for their needs, and another 19.1% said they haven’t found the right qualified provider to implement solutions.

Overall, auto professionals still have frustrations with digital tools.

The largest number of respondents (43.6%) said the biggest weakness with their current digital financing tools is that they are too difficult to implement.

Breaking down results even further, Wolters Kluwer found:

—38% of participants said theses don’t create the efficiencies they need

—Another 29% said their customers are not yet ready for digital financing

—27% said they don’t have the full suite of solutions to match their needs

Nearly half of respondents said about a third of their deals have errors and mistakes because they still utilize manual or paper processes.

Wolters Kluwer mentioned 15% of respondents said their continued use of manual and paper has led to roughly half of their deals containing errors.

However, Wolters Kluwer pointed out that many using digital are finding great customer efficiencies.

According to 62.7% of those surveyed, they said it takes customers longer than 30 minutes to complete a sale when the customer has to sign all documents via traditional paper-based materials.

However, 95.5% of respondents using digital said it takes customers less than 30 minutes when signing documentation using digital tools.

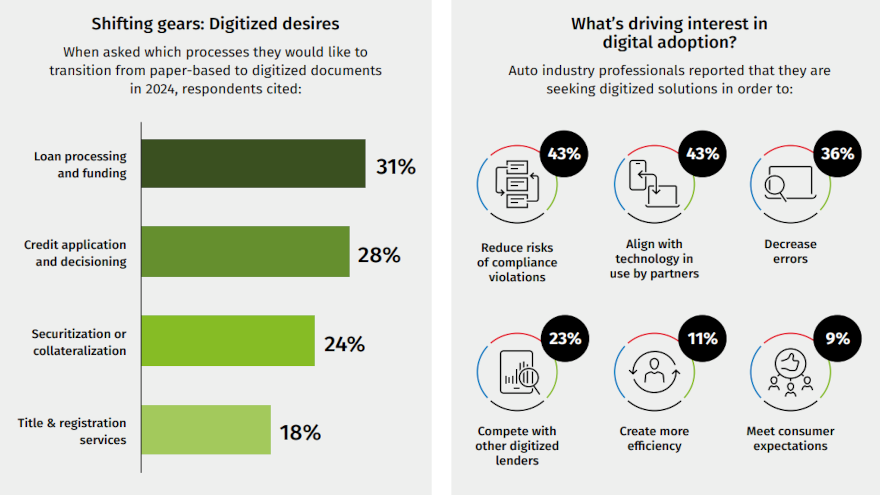

Heading into 2024, 31% of respondents said they want to transition loan processing and funding over to digitized documents.

Another 28% said they’d like to transition credit apps and decisioning to digitized documents; 23.6% said securitization and collateralization; and 18.2% said title and registration services.

In terms of handling a potential increase in demand for delinquencies, refinances, and pent-up sales demand in the next one or two quarters, Wolters Kluwer highlighted the largest number of respondents (26.4%) said they would like to adopt more digital to handle the increase.

A quarter (25.5%) said they are concerned about the potential uptick and want to digitize sooner than later, and 22.7% said they want to digitize but are unsure how it will help.

One other part of the survey noted that more digitization is needed for lien and titling work.

Regarding titling workflows, 53.6% of those surveyed said they are most concerned with staffing up for additional volume, and 40% said they are concerned about remaining in compliance with regulatory changes.

Wolters Kluwer noted that 36% said they are concerned with handling the growing volume of paperwork. A third of respondents (36%) said they are either not capable or unsure about being able to handle an increase in cross-state ownership changes with current title processing.

“These results tell us that as the automotive industry continues to evolve into more of a digital age, it is increasingly important for auto lenders to embrace the transformative power of digitization,” said Tim Yalich, head of motor vehicle strategy for Wolters Kluwer. “In a landscape where speed, efficiency, and seamless customer experiences reign supreme, leveraging cutting-edge technologies isn’t just an option; it’s a strategic necessity.

“The future belongs to those professionals who leverage innovation, and in the realm of auto lending, the journey toward success begins with the acceleration of digitization,” Yalich went on to say.

View The Latest Edition

View The Latest Edition