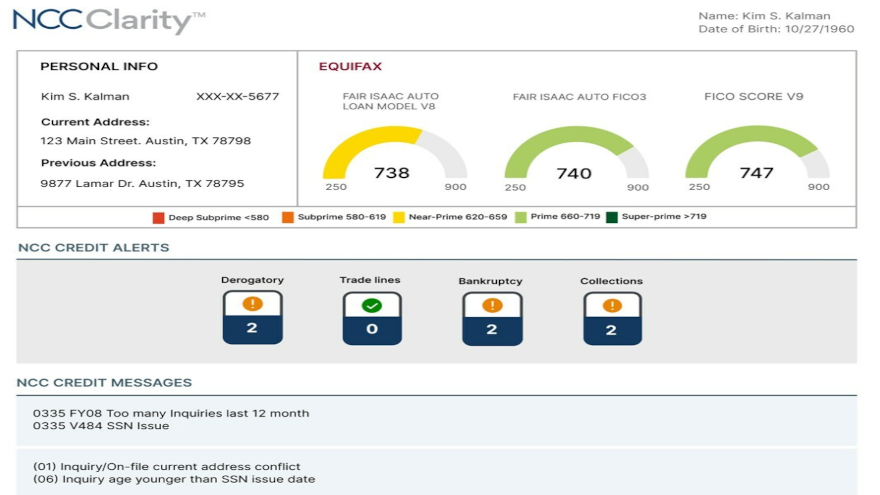

3 credit & financing capabilities of NCC Clarity

Image courtesy of National Credit Center (NCC).

Del Grande Dealer Group CEO Jeremy Beaver called the latest tool from National Credit Center (NCC) a “game changer.”

What triggered such a reaction about the NCC Clarity credit report? “It allows our team to quickly focus on the most important data to identify the right lender and improve our guests’ experience in our dealership,” Beaver said in a news release from NCC highlighting the three key features of the tool.

Those include:

—Intuitive design: NCC Clarity features a simple and clear design that’s geared for the fast-paced world of automotive finance to optimize productivity.

—Critical alerts: NCC Clarity has a new NCC Alerts summary bar that offers a snapshot of vital details at the top of the report, enabling access to critical information to identify the right finance company for each buyer.

—Auto-specific insight: NCC Auto Analytics provides auto trade lines and details including current finance company, monthly payment and APR. This product is designed to give dealerships the data needed to quickly structure the right contract terms.

National Credit Center president Brian Skutta said NCC Clarity was designed by F&I managers for desking managers.

“We’re delighted by the overwhelming excitement we’ve received on our NCC Clarity credit report and the impact it’s having on our dealerships’ business,” Skutta said in the news release. “For dealerships, the credit report hasn’t had innovation in years and we’re proud to be leading the way.”

NCC Clarity is available to all National Credit Center customers in the systems many dealerships use today including NCC Complete Credit, Dealertrack, RouteOne and other integrated platforms.

View The Latest Edition

View The Latest Edition