4 more findings from Open Lending’s 2024 Vehicle Accessibility Report

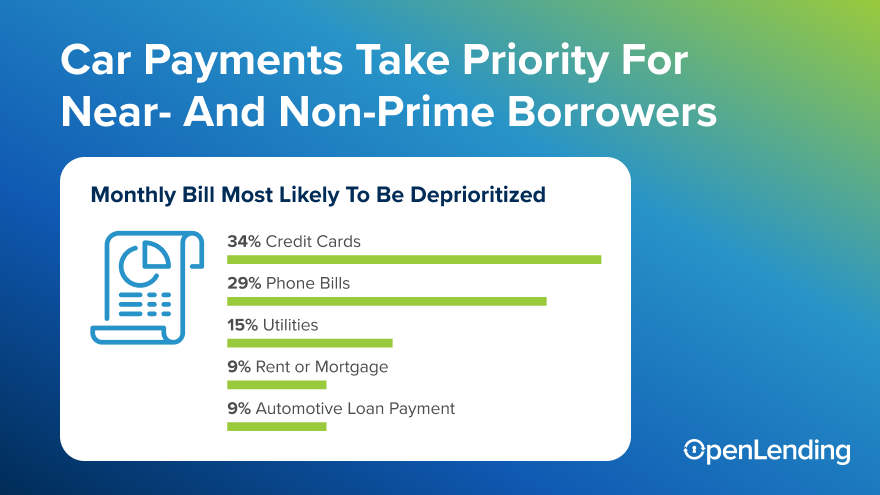

Graphic courtesy of Open Lending.

As the company pledged to do when releasing some initial findings late in January, Open Lending Corp. pushed out its entire 2024 Vehicle Accessibility Report this week.

The report aims to illustrate how traditional underwriting practices have alienated and excluded many creditworthy near- and non-prime consumers, providing insights to help automotive finance companies offer reasonable contract opportunities to individuals in this underserved but deserving credit segment.

Using survey results from 1,042 U.S.-based consumers who fall within either the near-prime (620-659) or non-prime (580-619) credit tier, Open Lending highlighted other key findings from the report that include:

Near- and non-prime consumers are proactive about managing debt, have purchase intentions and maintain a positive outlook on their financial futures.

Open Lending discovered 69% of near- and non-prime car owners plan to pay off their contracts early. Further, 74% expect their financial situation to improve over the next year, and 63% plan to purchase or trade in a vehicle within two years.

Due to decreased affordability and low transparency, near- and non-prime consumers are buying more used vehicles outright or seeking alternate routes to car ownership, according to Open Lending.

Of nearly one-third (32%) of respondents who purchased their vehicle outright, Open Lending determined 38% did so to avoid debt, and 21% sought to forgo costly monthly payments and fees.

The survey indicated nearly half (48%) view securing the right interest rate as the most confusing or unclear part of the automotive lending process.

Near- and non-prime consumers feel the sting of finance companies’ focus on credit scores.

For some, this makes it hard to trust financing providers, according to Open Lending’s analysis.

The survey showed nearly half (48%) of near- and non-prime consumers do not fully trust financial institutions to offer honest, reasonable terms on automotive financing, with some reporting they have experienced bias in the underwriting process.

Gen Z near- and non-prime consumers are financially cautious, hesitant to take on unfavorable contract terms and quicker to purchase a car outright.

Open Lending said 61% of car-owner respondents ages 18-42 have a term limit of 48 months or less, compared to just 42% of those aged 43-68.

Meanwhile, of the Gen Z respondents who purchased their vehicles outright, 22% did so because they were unsatisfied with the loan rate or repayment terms offered to them, according to Open Lending’s research.

Open Lending has focused on the near- and non-prime consumer for more than two decades in an effort to gather deep expertise and experience in this segment’s challenges and opportunities.

Open Lending chief revenue officer Matt Roe said many near- and non-prime consumers are creditworthy but overlooked by finance companies, creating a missed opportunity for financial institutions and deserving borrowers.

Through research and analysis, the company aims to empower automotive lenders to serve more consumers while growing return on assets and achieving yield targets.

“Many of today’s near- and non-prime consumers are the prime borrowers of the future. Overlooking creditworthy loan applicants in this segment stalls upward mobility and puts the automotive industry at risk,” Roe said in a news release “To stop these consumers from being pushed out of the market altogether, automotive lenders must offer accurately priced loans that applicants can accept.

“AI, alternative data and predictive analytics make this possible. By capturing a more detailed image of an applicant’s creditworthiness, lenders can offer reasonable loans to near- and non-prime consumers while prioritizing portfolio performance and risk management,” Roe went on to say about an opportunity for banks, credit unions and captive finance companies to improve long-term profitability by building trust with this excluded market through personalized financing opportunities.

The entire report can be downloaded via this website.

And Open Lending senior vice president of marketing Kevin Filan discussed the report during an episode of the Auto Remarketing Podcast recorded at the Vehicle Finance Conference hosted by the American Financial Services Association in February in Las Vegas.

That podcast can be heard in the window below.

View The Latest Edition

View The Latest Edition