Consumers eager to buy cars as credit availability & portfolio trends soften

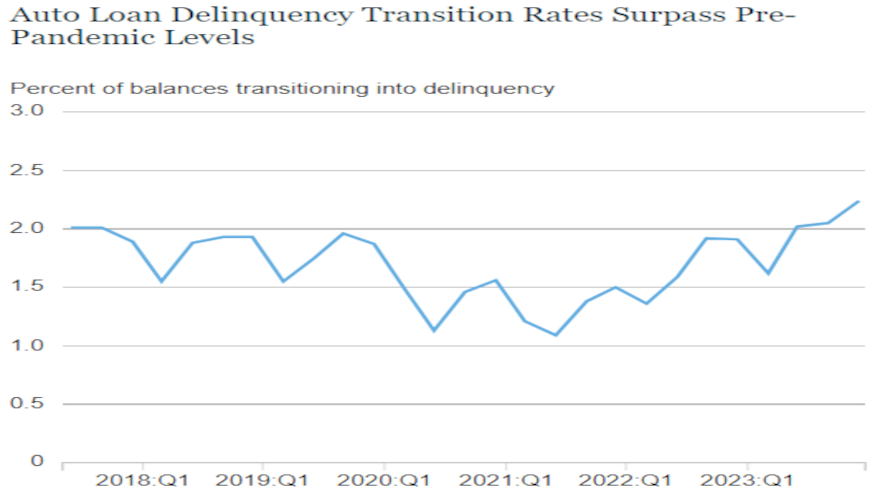

Chart courtesy of the Federal Reserve Bank of New York.

Despite tighter credit availability and one view of delinquencies showing them higher now than before the pandemic, at least one consumer-driven economic reading showed that people are eager to buy a car.

In this economic roundup from three different sources, Cox Automotive chief economist Jonathan Smoke on Monday summarized a pair of consumer sentiment readings. One highlighted that individuals seem to be as geared up to make a car purchase as they’ve been in nearly three years.

Here’s what Smoke recapped in his weekly blog.

“The initial February reading on Consumer Sentiment from the University of Michigan increased 0.8% to 79.6 as views of current conditions declined, offset by increases in future expectations,” Smoke wrote.

“Expectations for inflation increased as the median expected inflation rate over the next year increased to 3.0% from 2.9% last month, but the longer-term view of inflation was steady at 2.9%. Recent inflation data and readings on gas prices in February indicate that consumers are indeed seeing price increases to start the year,” he continued.

“Vehicle prices continue declining, and consumers’ views of buying conditions for vehicles improved to the best level since July 2021,” Smoke went on to mention.

Smoke added that the daily index of consumer sentiment from Morning Consult “points to a small increase as well in the first half of February.”

As of Thursday, Smoke noted that particular index reading increased 0.8% for the month.

Of course, what could help grease the vehicle-delivery wheels is a decrease in interest rates. Comerica Bank chief economist Bill Adams and senior economist Waran Bhahirethan discussed that potential in an analysis also released on Monday.

“The minutes of the Federal Reserve’s January Federal Open Market Committee meeting may clarify how much more ‘good data’ the Fed’s policymakers want to see before starting to reduce interest rates,” the Comerica Bank experts said. “Chair (Jerome) Powell said at the press conference following the January decision that he saw a March cut as unlikely, but was uncharacteristically vague about exactly what the Fed’s preconditions for cuts are; this suggests FOMC members still disagree about the issue.

“The minutes are also likely to shed light on the discussion planned for the March meeting about slowing the pace of the Fed’s balance sheet reduction,” Adams and Bhahirethan added.

No matter the improved consumer sentiment and potential for a softening in interest rates somewhere down the road, Cox Automotive pointed out that credit availability for auto financing is tightening.

In fact, the newest Dealertrack Credit Availability Index declined to 93.0 in January. That’s 3% below a year ago, marking the lowest level since August 2020.

And paper currently in finance company portfolios isn’t doing too great, either, based on what analysts at the Federal Reserve Bank of New York found through Equifax data.

The New York Fed reported earlier in this month that auto delinquency transition rates have surpassed pre-pandemic levels, pegging the reading at 2.24% at the close of 2023.

“With the pandemic policy supports in the rearview mirror, delinquency rates for most credit types have been rising after having reached very low levels during 2021. Concentrating on auto loans, delinquency transition rates have pushed past pre-pandemic levels, and the worsening appears to be broad-based,” the New York Fed said through a blog post that elaborated about its findings based on consumers’ age and residence.

“Loans opened during 2022 and 2023 are, so far, performing worse than loans opened in earlier years, perhaps because buyers during these years faced higher car prices and may have been pressed to borrow more, and at higher interest rates,” the New York Fed continued. “The increasing transition rates merit monitoring in the months ahead, particularly with the amplified distress shown by borrowers in lower-income areas.”

View The Latest Edition

View The Latest Edition