Lane watch: Pondering potential impact of money back on new-model hoods

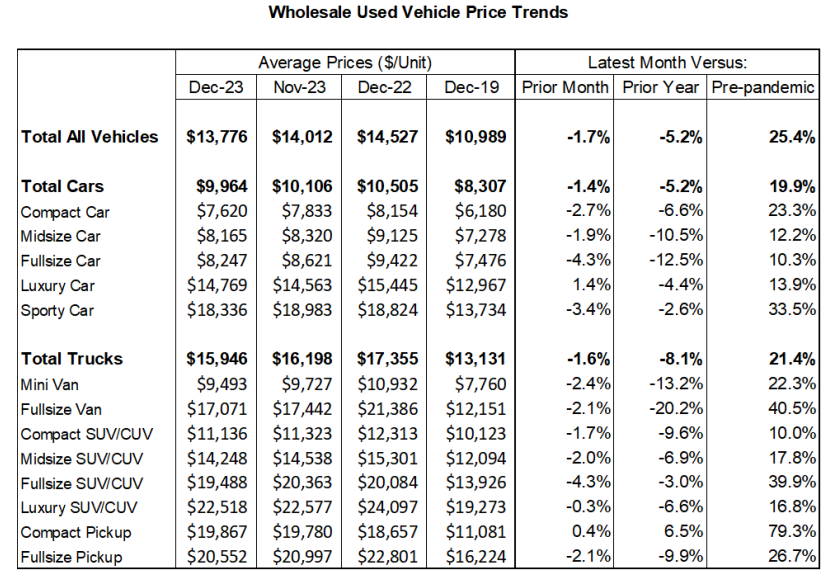

Chart courtesy of ADESA.

The latest wholesale market updates from ADESA US Analytical Services and Black Book both mentioned the same new-car market trend potentially influencing what might happen next at auctions.

Experts at each firm noted money is being slapped on the hood again to get new models delivered.

So, what are consignors and dealers currently doing in the lanes?

Beginning first with ADESA, its monthly analysis of used-vehicle prices by model class showed that wholesale prices in December averaged $13,776. That’s 1.7% lower compared to November and 5.2% below the reading in December 2022.

However, it’s still up a whopping 25.4% versus the pre-pandemic time in December 2019.

Here’s what ADESA chief economist Tom Kontos had to say in his latest installment of the Kontos Kommentary.

“Average wholesale used-vehicle prices fell for the third month in a row in December but have clawed their way back up a bit so far in January,” Kontos said. “On a year-over-year basis, however, used-vehicle prices are continuing their ‘correction’ to more-normal historical patterns relative to No. 1, their MSRPs (i.e., depreciation), No. 2, new-vehicle prices (i.e., discounting), and No. 3, the time of year (i.e., seasonality).

“Nevertheless, prices remain more than 25% higher than pre-pandemic levels,” Kontos added.

Black Book echoed Kontos’ observations through its newest edition of Market Insights, which noted that overall wholesale prices softened by just 0.49% during the week that closed on Saturday.

That price softening arrived with Black Book indicating the estimated average weekly sales rate dropped slightly to 54% “as sellers started to adjust floors to reflect the stabilizing market.

“For the second week in a row, we’ve seen depreciation slowing down, with multiple segments even reporting positive price movement,” Black Book said in the report. “However, in the auction lanes, we are still seeing mixed prices across the country. But over the last two weeks, we have started to see a shift in the market.

“For the first time in a few years, new inventory is increasing, and incentives are becoming more common,” Black Book went on to say. “How will this affect the wholesale market?”

That potential impact will come with prices for cars and trucks moving in these directions, according to Black Book tracking.

On a volume-weighted basis, analysts found that overall car segment values decreased 0.37%.

Black Book pointed out 8- to 16-year-old cars held their value even more, declining by just 0.18%.

In fact, three of the nine car segments increased in value last week. They included compact cars (up 0.03%), full-size cars (up 0.01%) and sporty cars (up 0.06%).

And looking even closer at those older cars, Black Book specifically mentioned price increases for compact cars (up 0.38%), full-size cars (up 0.36%) and sporty cars (up 0.23%).

Heading counter to a positive direction were subcompact cars, as Black Book said overall prices for those fuel-efficient units decreased another 1.79% last week after falling 1.02% a week earlier.

In the truck department, Black Book reported that overall truck values decreased 0.53% on a volume-weighted basis.

Analysts determined values for trucks up to 2 years old declined 0.38% on average, while values for trucks 8 to 16 years old decreased by 0.46% on average.

While prices for all 13 truck segments declined last week, Black Book pointed out only one posted a value drop exceeding 1%.

Analysts said the minivan segment continues to report notable depreciation, dropping another 1.05% last week. The segment has averaged a depreciation reading of 0.99% during the past 16 weeks.

Black Book mentioned the price strengthening of full-size pickups, too, as values declined just 0.15% last week. That was the smallest single week decline for them since June. A week earlier, prices for full-size pickups dropped 0.63%.

Meanwhile, values for small pickups are tumbling since Black Book pegged the price drop for those units at 0.91% and 0.62% during the past two weeks.

View The Latest Edition

View The Latest Edition